You might as well know that I’ve mostly avoided rental properties. Yes, I have had (and do currently have) a large number of single family homes, however, I’ve tried to justify my fleet of empty houses as “pending disposition.”

You might as well know that I’ve mostly avoided rental properties. Yes, I have had (and do currently have) a large number of single family homes, however, I’ve tried to justify my fleet of empty houses as “pending disposition.”

While that might be accurate, it’s not the entire truth. Fact is, while I had rental homes going back to the early 1980’s, I found myself a less-than-skillful landlord. Combined with my early reluctance to spend money on them and lack of willingness to turn them over to a professional manager, I ultimately got out of the rental business some twenty years ago. I’ve have a number of investment-grade apartments, as well as some D property units in Long Beach, CA, those were professionally managed and I was mostly passive in the day-to-day activities.

However, I found that I enjoyed the probate money lending and buy-sell business models much more, and mostly stayed away from opportunities to acquire great little rental houses.

Along the way, I’ve purchased, taken back, traded, bargained for, and otherwise “ended up” with a number of single family homes in and around So Cal, mostly the L.A. area. While I do plan to sell most all of them, sooner or later, I know that this market would beat me over the head if I tried to sell the better properties. So, I’ve decided to wait it out for the 3-5+ years that may be required before I can put them on my sales conveyor belt.

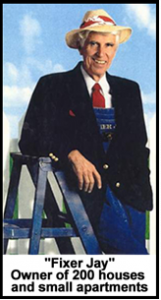

Which brings me to “Fixer” Jay DeCima, from Redding, CA. Jay is an old school kinda guy, meaning he’s big on relationships and how he works with people. Technology? Not so much.

Jay teaches several great seminars, the one that my buddy Will and I attended is called “Tenants and Toilets.” That’s about as straight-forward as you can get!

Jay’s class was three days of no-nonsense property management, with an emphasis on people management. Sense his target market is the lower end of the tenant spectrum, including some HUD Section-8 folks and other people who are not at all prosperus, this fits my mix of propective tenants. (Just so you didn’t think that my rental fleet was some kind of list of ocean front Malibu properties).

I believe that this is going to be an integral part of getting thru the next few lean years. So, even though it hasn’t been a big goal to acquire rental houses, I think that it’s a great way to make a non-performing asset, like a little house, pay it’s way until the next economic boom. Who knows, I might decide I like them and keep them.